Exceptional Suggestions To Aid You With Home Mortgages

Content by-Blalock HoffmanLooking for the right mortgage can take a little time. That is why it's a good idea to prepare in advance. The process of closing on a mortgage takes time as well, and you don't want to find yourself in an undesirable situation. Instead, you want to be happy that you've found the right mortgage, so keep reading!

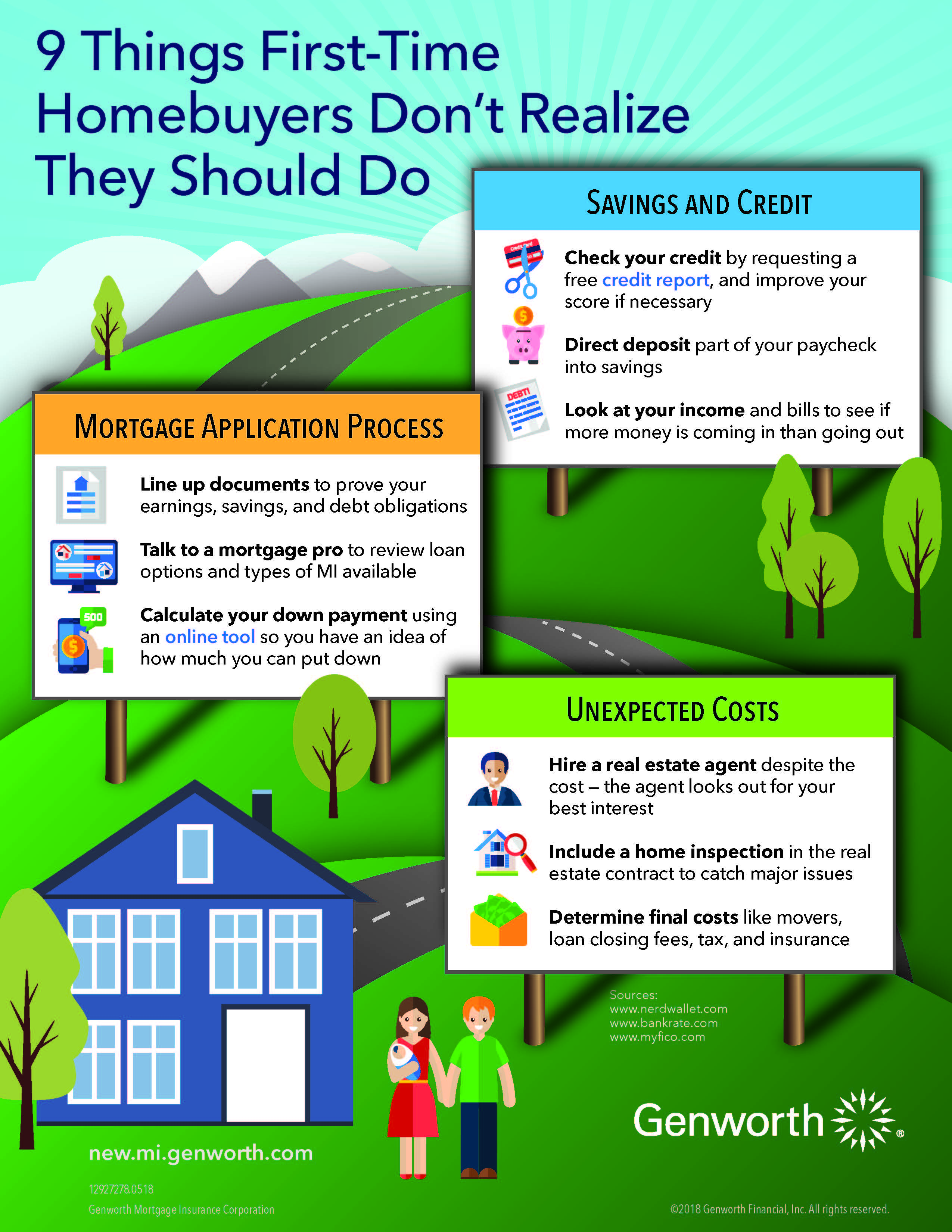

To make sure that you get the best rate on your mortgage, examine your credit rating report carefully. Lenders will make you an offer based on your credit score, so if there are any problems on your credit report, make sure to resolve them before you shop for a mortgage.

Before applying for a mortgage, pay down your debts. Lenders use a debt to income ratio to verify that you are able to afford a mortgage. A general rule of thumb is 36 percent of your gross income should be available to pay all of your monthly expenses, including your mortgage payment.

Your loan can be denied by any changes in your financial situation. Avoid applying for mortgages without a secure job. Never change jobs after you have applied for a mortgage.

Try shopping around for a home mortgage. When you do shop around, you need to do more than just compare interest rates. While they're important, you need to consider closing costs, points and the different types of loans. Try getting estimates from a few banks and mortgage brokers before deciding the best combination for your situation.

Predefine terms before your application process, not just to prove to your lender that you are able to handle any arrangements, but also to keep it within your monthly budget, too. You must have a set budget that you are sure that is affordable in the future, and not just focus on the home you want. Stay out of trouble by only getting a mortgage you can afford.

Make sure that all of your loans and other payments are up to date before you apply for a mortgage. Every delinquency you have is going to impact your credit score, so it is best to pay things off and have a solid payment history before you contact any lenders.

Make sure you look at multiple mortgage lenders before settling on one. You definitely need to do some comparison shopping. There are a lot of different mortgage rates and deals out there, so stopping at just one could really mean wasting thousands of dollars over the life of your mortgage.

When financing a house, giving a large down payment will result in a lower mortgage rate. This is due to the fact that a big down payment will reduce your loan to value ratio. When the loan to value ratio gets lower, the interest rates become more favorable for the home buyer.

Before you begin home mortgage shopping, be prepared. Get all of your debts paid down and set some savings aside. You may benefit by seeking out credit at a lower interest rate to consolidate smaller debts. Having your financial house in order will give you some leverage to get the best rates and terms.

Chose a bank to carry your mortgage. Not all companies who finance homes are banks. Some of them are investment companies and private corporations. Though you may be comfortable with them, banks are usually the easier option. Local bankers can usually cut down the turn-around time between application and available funds.

Be careful when taking out a second line of financing. Many financial institutions will allow you to borrow money on your home equity to pay off other debts. Remember you are not actually paying off those debts, but transferring them to your house. Check to make sure your new home loan is not at a higher interest rate than the original debts.

Before you begin home mortgage shopping, be prepared. Get all of your debts paid down and set some savings aside. You may benefit by seeking out credit at a lower interest rate to consolidate smaller debts. Having your financial house in order will give you some leverage to get the best rates and terms.

If you have bad credit, avoid applying for a home mortgage. Although you may feel financially ready enough to handle the costs of a mortgage, you will not qualify for a good interest rate. This means you will end up paying a lot more over the life of your loan.

Compare more than just interest rates when you are shopping for a mortgage broker. A low interest rate is what you want. Also, you need to go over every type of loan that's out there. Additionally, you need to think about closing costs, down payments and every other kind of cost that will come into play.

Never choose a home mortgage from a company that asks you to do unscrupulous things. If a rep is asking you to claim more than you make to secure the mortgage, it's not a good sign that your mortgage is in good hands. Walk away from these deals as quickly as you can.

Compare conventional loans to FHA loans. A lot of buyers opt for a Federal Housing Administration (FHA) mortgage because they can give as little as 3.5 percent down when buying a home. https://www.cnbc.com/2021/06/29/why-you-should-always-transfer-your-venmo-balance-to-the-bank.html requires at least 5 percent down. If you can give a higher down payment, get quotes for both conventional and FHA loans and do a cost comparison.

Keep closing costs in mind. You might be focused totally on the excitement of beginning your homeownership. But, you are more than likely going to have to cover a few percentage points of the closing costs of the mortgage in order to secure the deal. Know how this works in your locality and be ready to spend.

pop over to this site of the tips in this article aren't available elsewhere, so you should have some new knowledge you had never considered previously. That means you are now ready to go out and get yourself that mortgage. No more negative thoughts will enter your mind as you complete the process confidently instead.